John Distilleries Ltd.’s Paul John single malt whiskey ‘Nirvana’ has been awarded “Gold” medal in the prestigious London Spirits Competition 2024. JDL’s two other offerings –...

The circular by DGCA now mandates airlines to allocate seats for children up to the age of 12 years with at least one of their parents/guardians....

According to the Oxford International’s Student Global Mobility Index (SGMI), the United States remains the top destination for Indian students pursuing higher education abroad, despite concerns...

Reliance Industries Limited, Lucas TVS, and Waaree Energies are among the seven companies from whom the Ministry of Heavy Industries (MHI) has received bids in response...

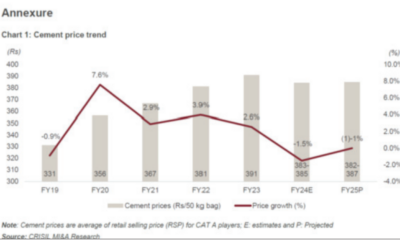

India’s cement industry will see a tapering of demand growth to 6-7 per cent in fiscal 2025 after a third straight year of healthy demand growth...

In both cases, rates of expansion driven by increase in aggregate business activity resulted in the highest composite output index since June 2010 and the fastest...

That has begun to change with the help of smart electricity meters, artificial intelligence and modelling by innovative energy companies. Automakers from General Motors to Volvo...

The bank anticipates prices to average $10,000 per metric ton by the year’s end and to rise to $12,000 by 2026. Hindustan Copper, a state-owned mining...

UPSIDA, the state nodal agency, has acquired 25,000 acres of land across 75 districts, facilitating specialized industrial clusters like the recent allocation in Lalitpur for a...

Reliance Industries on Monday posted a net profit of Rs 18,951 crore in the March quarter (Q4) of FY24, a 1.8 per cent decrease in its...