With the farm Acts no longer under consideration, the government might focus on reforming the input aspect of the agriculture sector, which includes regulations and rules...

The Centre has taken cognizance of the charges made against Nestle of adding sugar to infant food products in India. The government has acknowledged allegations against...

After a challenging year marked by low profitability, the cotton yarn spinning industry is poised for improvement this financial year, according to a report by Crisil...

Travellers between India and Dubai are facing significant disruptions at Dubai International Airport (DXB) due to unprecedented rainfall, with multiple flights cancelled and travellers stranded in...

India’s Food Safety and Standards Authority (FSSAI) is reviewing the report and will present it to a scientific panel for further evaluation. Shares of Nestle India...

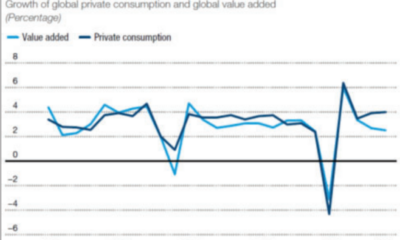

Krishnamurthy V. Subramaniam, the Executive Director of the International Monetary Fund (IMF), said on Tuesday that India will continue to be a driver for global growth...

The Israeli offensive in Gaza aimed at destroying Hamas has caused widespread devastation and killed over 33,800 people, according to local health officials. On Tuesday, the...

The plan introduces a revamped ticket refund scheme ensuring refunds within 24 hours, streamlining the process and improving customer satisfaction. In a significant move aimed at...

Amidst India’s equity market emerging as the 5th largest globally by market capitalisation with exponential increase in retail investor participation, Indian industry has called for stimulating...

India was one of the ‘large economies — apart from China, Indonesia, the Russian Federation, the United States, among others – which escaped the financial trouble...